Strategic Longterm-Income Investments in Real Estate using Monte Carlo simulations

- socialmediaemaildz

- Mar 17, 2021

- 4 min read

Updated: Apr 20, 2021

Intro

In this article I would like to focus on the practice many commercial real estate companies are choosing, especially in turbulent market conditions — to close long term real estate leasing contracts in order to secure their income in the mid to long run. This is a very interesting approach, from the liquidity as well as the investment point of view.

I will go through some basics of decision making process and the logic behind it, from investment and asset management point of view, while discussing the possibilities using data driven analytics tools, especially mid-long term predictions in order objectivise the market development expectations.

What are in fact challenges and opportunities of a longterm-income real estate approach?

The attractiveness of this practice lays without any doubt in securing a steady flow of liquidity for a longer period of time. Once fixed, market rent fluctuations, re-renting risk as well as re-renting costs are not the primary considerations any more. Of course, a possible counterpart risk may have a certain counterweight in this scenario, but in general this is a good way to secure some stability, especially when the market starts to get unsteady.

From an investment point of view the risks might look a bit different… Investment decisions for commercial real estate are based on several key indicators. One factor which plays a very important role is the lease term structure of the target asset.

In case the rent prices of an asset are somewhere around market levels, the longer the average lease term of a project goes, the more attractive the investment is seen. An investor is buying an asset which has a steady cash flow secured for many years to come. This is the ideal option real estate companies are hoping for.

Consequently, if the lease term is too short, the target investment may face a deduction in the final purchase price respectively the potential investor may refrain from the investment at all.

Overall, a longterm income asset provides a lot of convenience in terms of running liquidity and may be some sort of buffer in market valuations in case yield and/ or rent price developments are not in favour of asset holders. On the other hand, it hinders an asset to participate in the full swing of optimistic market behaviours.

So, the decision to invest in those kind of assets therefore should depend on the overall strategy an investor has

And for backing the strategy, mid- to longterm predictive analytics tools are very helpful to offer insights into potential developments which are likely to take place in this period of time.

Opportunities data driven solutions are “bringing to the table”

If we think about the responsibility of decision makers for their long term decisions there is nothing new here! This was always the risk on executive level and decision makers always had to rely on their experience, knowledge of the market… as well as a bit on their “gut feeling”.

However, now we have additional possibilities to make the decision making process less intuitive and more objective and data driven, increasing transparency and gaining competitive advantage.

We are able to take into account all of the market indicators and to derive their exact relations in the present, as well as to make short and mid-long term predictions regarding their further development.

In this particular case, using network dynamics modelling in combination with Monte Carlo simulations may help us to:

use available market data to uncover hidden risk dynamics, by defining financial risk clusters (using network dynamics modelling)

use this as a basis for statistical mid to long term simulations in order to see how the market is likely to behave in the course of a potential longterm lease term and therefore to have an objective basis for the decision.

The aim is to enable a decision maker to put the assessment of upcoming market circumstances on a strategic level and hence, to catch the right timing for promoting longterm-income asset investments respectively to more focus on the liquidity impact.

Longterm-Income Real Estate/ An Example

So, in order to better understand this approach let us do an example.

We would focus on how units with extraordinary lease terms, i.e. 10+ years are likely to be doing compared to those with more ordinary lease terms.

First, we want to establish whether there is any stabilising effect on a real estate portfolio by implementing assets with extraordinary lease terms.

Let’s assume a project with:

15 years lease term fixed at prevailing market rent level

a free floating market rent and investment yield

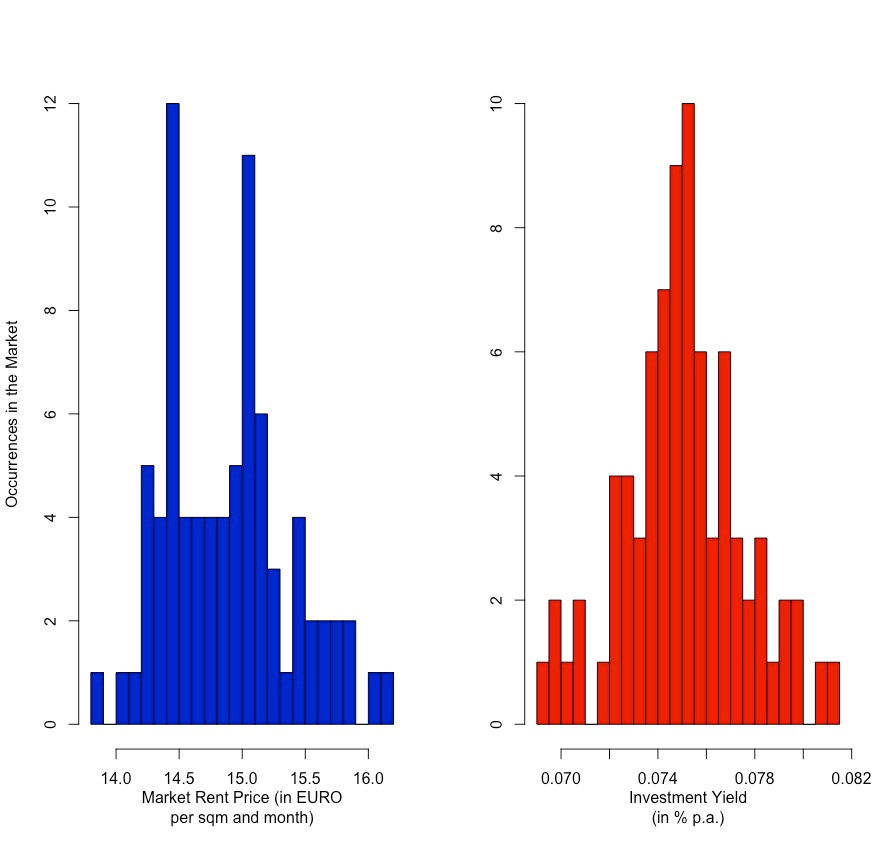

For this example, the two parameters (market rent, investment yield) float randomly within the following ranges:

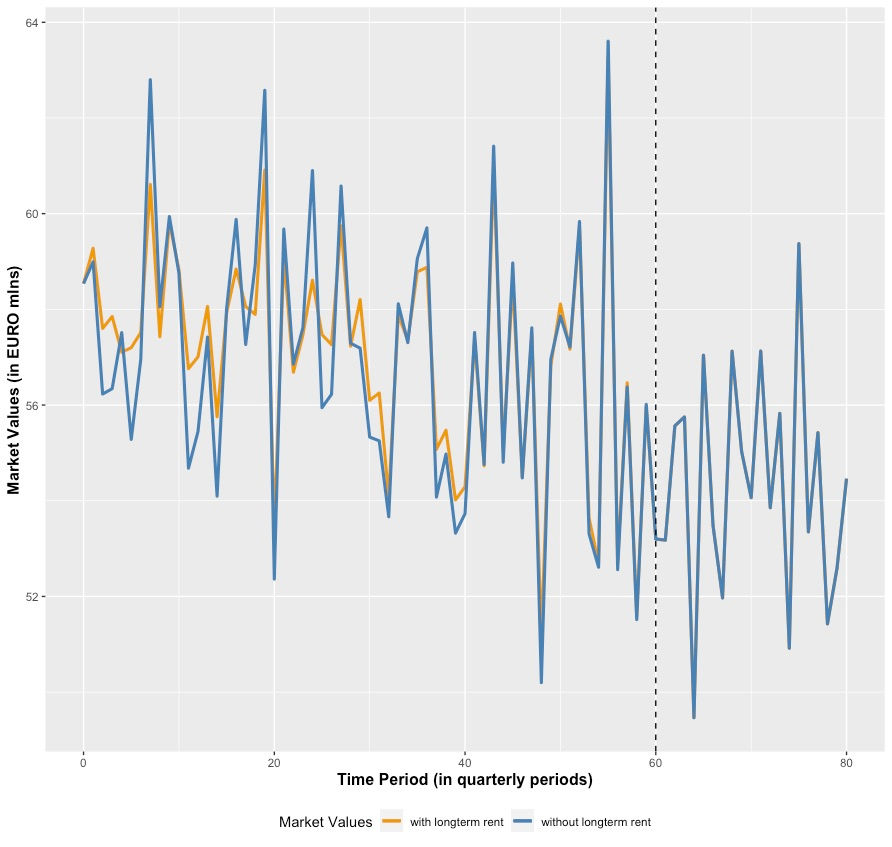

Based on this framework, the market values for the building with a longterm-income lease contract as well as for the same building without this longterm component, show the following development:

As can be seen in the graph, incorporating longterm-income in a real estate asset does not prevent market valuations from being quite volatile - although it smoothes the market value fluctuations over time (see the orange line) compared to assets with ordinary lease contracts (see the blue line). Of course, the impact flattens out with time and almost ceases to exist in the last third of the lease term.

Instead of conclusion — The next stage in risk management process

The fact is that close monitoring of market developments and a ongoing evaluation of potential market scenarios is essential to use the instrument of longterm-income assets effectively on a strategic level.

Though, this evaluation has to go beyond the usual contemplation of quarterly expectations. It has to incorporate future market scenarios with a mid- to longterm time range.

Monte Carlo simulations optimised by networks analytics methods while embedding cluster market risk considerations are powerful tools to achieve this goal. Those instruments allow to act on a strategic level which includes the possibility to act in due time before the market generally takes over a negative view.

Comments