Why Investment Volume Does Not Necessarily Guarantee Strong Markets

- socialmediaemaildz

- Apr 16, 2021

- 5 min read

Intro

Entering the second quarter of 2021 and the pandemic still has a grip on whatever we've known as normal life. As one of the consequences, uncertainty about future economic developments is rising. Though, you have anything from "....the economy will follow-up and rise to levels never seen before" to "....the worst is still to come".

Real estate markets are no exception to those developments, although the characteristics of the unfolding scenarios in different asset classes might be a bit different.

Residential in general has proven to be a very convenient investment harbour so far. The asset class logistics tends to gain from the structural shift in consumer behaviour accelerated by the ongoing lock-downs of brick-and-mortar business. This is part of the reason why the risk in the retail segment is driving up.

Office markets - neither are they an exception to the rising levels of uncertainty.

The market sentiment is additionally fuelled by different geographic markets having shown differing market dynamics while certain trans-regional markets are showing cluster-behaviour and are therefore changing significantly opportunity/ risk profiles.

A very supporting argument for sustainably strong real estate markets is the presence of a lot of capital flowing into this specific industry. Nowadays, increased yield gaps between state bonds and the asset class real estate are further promoting this trend.

In the context of current market uncertainties and the latter argument of strong markets with sufficient capital inflow there are two topics which would be very interesting:

Actually, let's have a look at the argument of higher capital flow supporting markets (in terms of market prices).

Also, let's see how to address the risk of rebounding markets provided that this very markets showed a permanent improvement over the last decade but are now facing exactly this increased uncertainty.

Capital Flow

Starting with the basics - the more interest in a certain market segment, the more capital flows into this market, the better the market thrives.

In case of yield driven real estate investment markets, a thriving market means compressing yield developments with rising market price levels.

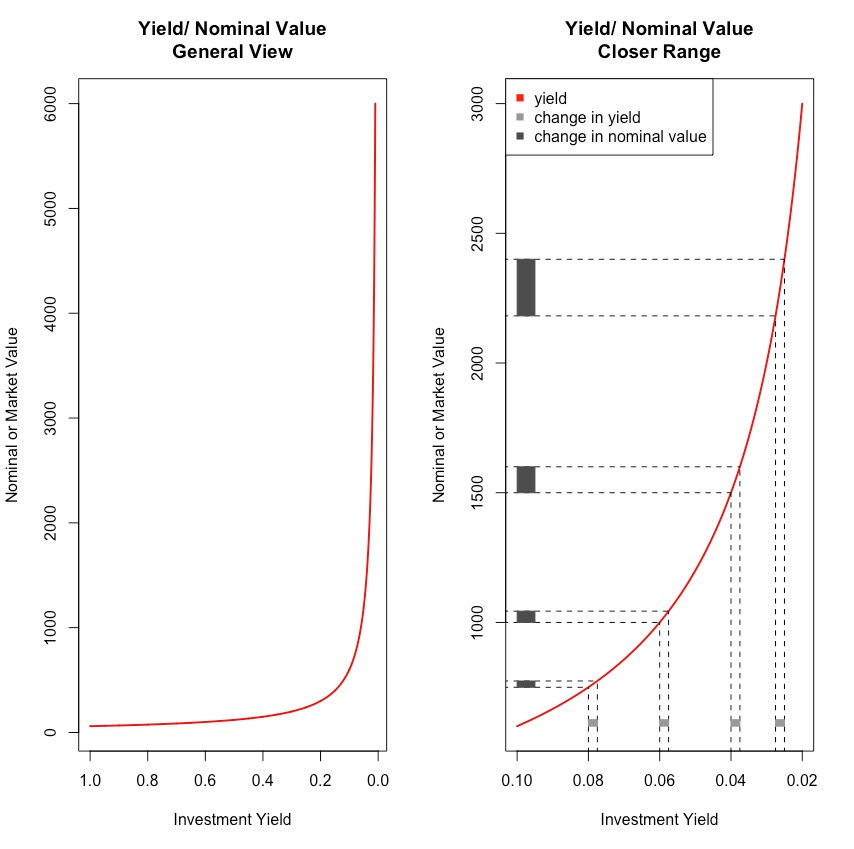

As shown in the left graph below, simple calculation reveals that the yield movement has an exponential effect on the nominal values of real estate assets.

And as displayed in the right graph, on lower absolute yield levels the same change in the yield (here, 25 bps each) has an incredibly much heftier impact on the nominal value of the asset.

Given current absolute yield levels prevailing in certain geographic areas, markets find themselves more and more in the situation that just slight changes in the yield level will cause a quite dominant rise in the market values of the real estate assets.

Consequently, funding requirements for real estate transactions get clearly higher.

For one and the same asset, the transaction price and therefore the capital necessities can get significantly higher, although in absolute yield terms there was not so much movement in the market.

Concluding this notion, this would mean that under current market circumstances in some of the regional markets, a steady increase in capital inflow might not be sufficient enough to back a positive market climate.

It's more that the amount of money to be invested in the market has to increase exponentially in order to enable further market improvements resp. to keep the market on current levels.

We could compare this situation with an airplane ascending with constant speed but getting heavier with the increasing altitude. At some point, one needs exponentially more fuel to keep the ascending pace.

How to deal with "ever thriving" markets?

Taking it from there, we have to ask, how - from a risk point of view - to deal with markets which have experienced an "ever" ongoing yield compression and therefore rising market price levels for meanwhile over a decade.

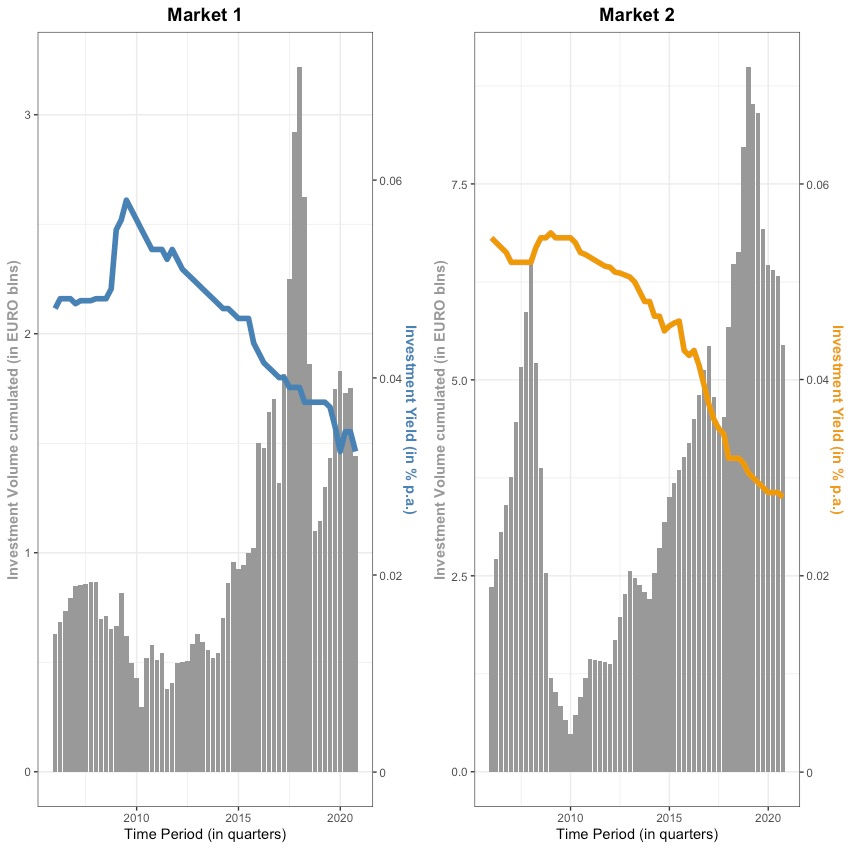

A lot of markets have seen a positive market sentiment as from the end of the last big financial crisis without showing any stronger sign of rebound during that period of time. Here is an example of two markets in all their optimism:

As most of us are aware, the uncertainty in the shadow of the current pandemic will still be rising. So, to exclude the option of a deeper correction in certain markets could be counterintuitive, if not to say negligent.

On the other hand, to constantly paint the picture of an upcoming big correction until it really happens (if any) is like the broken clock which is right two times a day.

However, from a risk perspective the possibility of a heavier market rebound is to be addressed, or better, is to be quantified in respective risk scenarios.

More than ever, we have now available sophisticated predictive risk instruments which do a great job in precisely incorporating this kind of risk moments, especially when recent empiric data do not give enough (or any) experience with respect to breaking market environments.

The adaptability of those predictive risk tools allows to embed latest market developments as they happen and puts a real estate company into the position to take precautionary measures for tougher times in an adequate intensity.

And definitely, they are much more flexible than traditional risk tools still operating within the range of worst/ best - case scenarios or dealing with sensitivity analysis for one market/ project parameter on a row.

Conclusion

Although the word "disruption" lost its charm due to its overuse, there is no better term to express the level of change, risk management operations have to face in order to answer to latest risk challenges especially in a global environment which is more and more data-driven and which goes through a radical digital transformation.

To stick to so-called best and worst case scenarios in circumstances where much more sophisticated tools and means are available to quantify and objectively analyse in-depth what is happening/ what is likely to happen in a market is not only a missed opportunity but more a potential business threat.

Any big real estate corporation has to be able to introduce digital transformation into its financial risk management in a way that is optimal for reflecting the biggest challenges the industry is currently facing and having in-depth insights into market dynamics is certainly one of the most important ones.

Guessing what might happen in the market on the one hand and being able to identify those trigger mechanisms, measure their impact and to quantify what is going to happen on the other hand are simply two different worlds. To be clear, it is a make-it or break-it difference.

In a more and more data driven world with digital transformation on any corner, risk management operations should definitely not stay in analogue times.

Find out more about Market Risk Radar solution, using predictive analytics to mitigate market financial risks

For more info and demo requests feel free to contact us!

Comments