Inappropriate risk management systems in the real estate industry

- socialmediaemaildz

- Jan 26, 2024

- 6 min read

During the last two years we’ve seen an increasing number of negative incidents connected to real estate corporate bonds which triggers the notion of what is to expected from defaulting bonds in terms of repayment, are those payment expectations properly incorporated in risk management systems and does a potential mismatch have any influence on current market developments.

In this article, we’ll have a look at those questions.

Signa Insolvency

With one of its subsidiaries filing for bankruptcy, Signa Development Finance S.C.S.’ 5.5% 21/26 bonds facility slipped into technical default as of end of December 2023.

Given the pricing development of the bonds facility, this outcome seems to have been broadly anticipated by market participants already:

The sequence of daily price changes gives an impression of the dramatic development during the last weeks:

Though the bonds price never really thrived, the great majority of daily price changes circulated around 0. And then, only two to three deep price jumps within recent weeks brought the bond facility down to its absolute minimum price level.

Pricing Pattern of Defaulting Bonds

Let’s have a look at the pricing development of other defaulting bonds respectively of bonds where the bonds issuers themselves already in trouble.

ProReal Secur 1 GmbH 5.75% 20/25

Eyemaxx Real Estate AG 6% 19/24

Aggregate Holdings S.A. 9.625% 20/25

Peach Property Finance GmbH 4.375% 10/25

One gets the picture. Most of the time, there is not too much price movement. And then comes the significant pricing shift downwards respectively a series of serious pricing declines.

Given the overall pricing behaviour, these rare occasions in daily price movements seem like outliers. But nevertheless, at the end of the day those outliers tend to dominate the whole pricing development.

Held to Maturity

Why to even bother?

Focusing on daily price movements is a speculative approach. Corporate bonds could be bought for their fixed (coupon) income which are in general more attractive than short-term notes or money market papers and be held until maturity.

Under those circumstances, yield considerations solely derive from the difference between purchase price and the full bonds repayment of the nominal value at the end of the term, coupon payments and the term to maturity of the bonds. All this while the probability of default, at least for the better graded papers, is low.

In this context, N.N. Taleb makes an interesting point:

For unimodal distributions, thick tails are the norm. But for multimodal distributions, some surprises can occur.

Take a bond B, paying interest r at the end of a single period. At termination, there is a high probability of getting B(1+r), and a small possibility of default. Getting exactly B is very unlikely. Think that there are no intermediary steps between war and peace: these are separable and discrete states. Bonds don’t just default “a little bit”.

Note the divergence, the probability of the realization being at or close to the mean is about nil. Typically p(E(x)), the probability density function of the expectation are smaller than at the different means of regimes, so P(x = E(x)) < P(x = m1) < P(x = m2), but in the extreme case, P(x = E(x)) becomes increasingly small. The tail event is the realization around the mean.

So even when held to maturity, a bonds facility can expose its investor to two different regimes. The first, calm one runs around a quite foreseeable payment structure and there is not too much of surprises.

With a bonds issuer defaulting (or being close to default), there is a quite fast and heavy regime change which puts payment structures in rather rough waters. The decline in pricing is swift and decisive and as empiric studies show, the final loss for a bonds holder is usually significant.

The following table represents an empiric study by the International Monetary Fund examining final losses of bonds from different industries which defaulted between 1983 and 1993:

In the majority of cases, the final loss scenario is between 50% and 100% of the nominal value of the defaulted bonds facility. And in general there is little hope (i.e. a small probability) of the final loss being less than approximately 40%.

Technical note: We took the data from the International Monetary Funds in terms of average loss and standard deviation per industry and approximated the loss scenarios by means of a t-Student distribution.

Another empiric study by Moody’s in 2006 shows a similar picture:

According to this study, the majority of the sample backs average losses of around 50% and more. Worth noticing, the loss patterns between investment-graded and speculative-graded bonds is quite similar.

This behavior, i.e. this bimodality in payment structures, should be considered when analyzing an investor’s risk exposure.

Risk Modeling

This bimodality in expected payment structures within one bonds facility, i.e.

regime 1: a higher probability of fixed payments accompanied by very low volatility

regime 2: a lower probability of default accompanied with a swift and decisive shift in terms of timing of payment as well as the amount of repayment and possibly surrounded by a high volatility

raises issues with classic risk analytics.

It is not enough to calculate possible loss scenarios just by fixing the average of expected payments and incorporating volatility into this scenario while allowing for fat tails to cover a higher degree of default probabilities. This unimodal approach will not give a true picture of possible loss scenarios in case of a default. To put it more distinct, the impact of losses is heavily underestimated.

Here, as an example, the expected profit/ loss distribution of a sample of bonds with a 4.5% p.a. coupon:

In this case, the probability of making a loss with this bonds investment would be around 15%. Though, the chance of taking a major hit (defined here by a loss of more than 50%) is just 0.15%.

Here is a more detailed focus on the loss area of this bonds investment (see the red zone in the chart below):

In this analysis, the majority of expected losses is between 0 and maybe 15% of the nominal value of the bonds. Though, losses of more than 30% are real outliers with extremely low probability.

Given empiric default repayment structures, this unimodal risk approach would not match “real life” and therefore clearly underestimates the danger of major blows in a bonds investment.

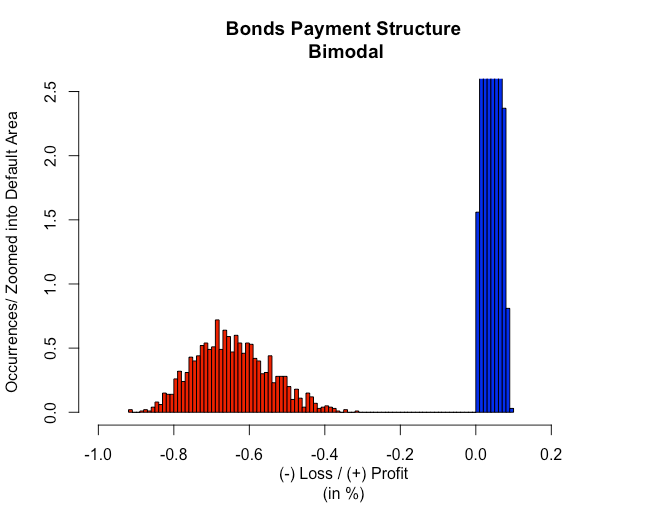

In order to countersteer this problem of abrupt changing payment regimes, a bimodal approach is to be implemented which puts the default regime in the “right place”:

Now, with the same bonds investment the probability of default is still around 15%. Though, the chance of taking a major hit (i.e. losses above 50% of the nominal value) rises to 13.7%. This is 91 times more than in the unimodal analysis.

When we zoom into the default regime again, the different behaviour of the payment pattern gets obvious:

It seems obvious, that not to take care for those risk circumstances could put an investor into the illusion, that its investment exposure is sound in terms of probability of default and manageable in terms of loss given default. Which is not!

As a result, very unpleasant surprises could be the order of the day.

Potential Consequences for the Real Estate Market

Real estate corporate bonds were detected as an important funding tool right after the big financial crisis (at least in Europe) and have fueled an ever-thriving market since then.

Hence, experiences with defaulting corporate bonds in the real estate business haven’t been too widespread.

This seems to have changed recently and the number of defaulting corporate bonds and/ or troubled bonds issuer has increased significantly during the last two years. The number of negative reports in real estate newspapers in the DACH region gives some indication for this development:

So, what we face in the European real estate arena is

deteriorating market conditions in many regions and asset classes;

an increasing number of defaulting bonds facilities respectively an increasing number of troubled bonds issuers;

a so far limited experience with defaulting bonds;

a possibly wrong risk analysis regarding the repayment potential of defaulting bonds which leads to a distinct underestimation of loss scenarios;

huge refinancing necessities for expiring bonds during the next 3 years.

Under these circumstances, the lack of experience with defaulting bonds and the underestimation of potential losses with bonds investments could hold some very troublesome situations for bonds investors. This fact becomes even more alarming considering the fact that 121 bln EUR are to be refunded in Europe in the next 3 years.

In case this triggers a retreat of potential bonds investors and no alternative financing tool with similar funding capacities can be found, we do have a Minsky moment in the doing!

References

Nun ist es offiziell: Signa-Development-Bond in Default published at Institutional Money/ December 27, 2023

Signa Development Bonds Pushed Into Default By Unit Insolvency published at Bloomberg/ December 22, 2023

Signa Development Finance S.C.S. 5.5% 21/26 chart data as published by Börse Frankfurt

Other chart data as published by Börse Frankfurt

Statistical Consequences of Fat Tails by Nassim Nicholas Taleb/ 2023

Recovery Ratios and Survival Times for Corporate Bonds by International Monetary Fund/ July 1997

Recovery Rates from Distressed Debt by Manmohan Singh — Working Paper International Monetary Fund/ August 2003

Measuring Loss-Given-Default for Structured Finance Securities: An Update by Moody’s / December 2006

Loss Given Default for Speculative-Grade Companies by Moody’s Investors Service/ December 4, 2015

Comments